hedge-fund.io

Simple Stock Valuation Part 1 - Ratio Scenario Matrix

Potential Sales and Price:Sales Ratio Scenarios for Sibanye Stillwater (SBSW)

Published: 06 July 2025

|

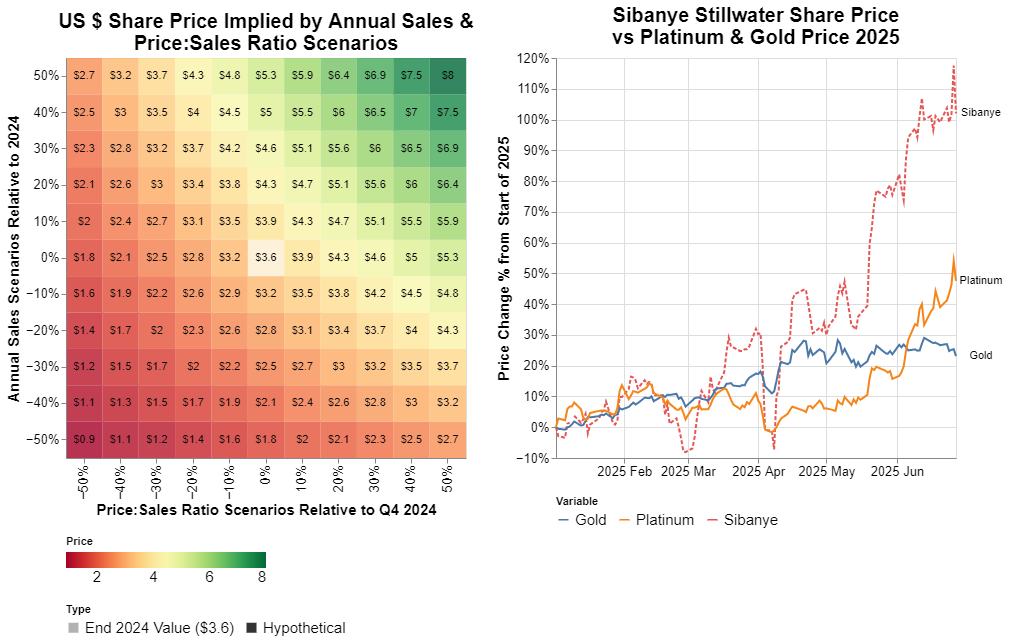

The Q4 2024 SBSW share price was $3.6 (centre of the scenario matrix), annual sales were $6.3 billion and the Price:Sales Ratio was 0.4. Each cell represents

a different scenario combination of Price:Sales Ratio, and annual sales. E.g. the top right cell shows that a 50% increase in the Price:Sales Ratio combined with a

50% increase in annual sales would imply a share price of $8 per share.

Platinum Price Has Surged in 2025Gold has been in the news a lot over the last year, with significant price increases in part driven by increased central bank buying and demand for hard assets. Platinum has received less coverage but is up 50% since the start of the year. Along with this increase in commodity price, the share price of some platinum miners have gone up significantly this year. This piece looks at using the Price:Sales Ratio of a South African platinum miner Sibanye Stillwater - SBSW and a simple tool (Ratio Scenario Matrix) to model potential share price scenarios.Sibanye StillwaterSBSW had $6.3bln of revenue in 2024. By the end of Q4 2024 the ADR share price (representing 4 shares) was $3.6 per share and with a float of 707 million ADR shares the market cap was around $2.54 bln. This reflected a Price:Sales ratio (PSR) of around 0.4. Most ($4.6bln/$6.3bln) of its revenue comes from South Africa and from platinum group metals ($3.4bln/$6.3bln) and gold ($2.1bln/$6.3bln).Therefore by the end of Q4 2024: \[ \text{Price:Sales Ratio} = \frac{\text{Market Capitalization}}{\text{Total Sales}} = \frac{\text{\$ 2.54 billion }}{\text{\$ 6.3 billion}} = 0.4 \] Can also be shown as: \[ \text{PSR} = \frac{\text{Share Price}}{\text{Sales per Share}}= \frac{\text{\$3.6}}{\text{\$8.9}} = 0.4 \] What share price scenarios might result if we vary the PSR and Sales up and down by 50% and assume other factors remain constant? Ratio Scenario MatrixThe Price:Sales ratio of a company measures how much investors are willing to pay for a dollar of revenue. Using the PSR we can model certain stock price scenarios by changing two variables: the PSR itself and the company’s sales. If we take the current values of these variables as midpoints in the scenario analysis, and create a range that goes from -50% to +50% for each variable, calculating an implied share price using those hypothetical values, we arrive at a ratio scenario matrix as above.In the more extreme cases where e.g. sales increases by 50% and the PSR increases by 50%, we can see that the implied share price is $8 which is 120% higher than the share price at the start of 2025. This is equivalent to annual sales increasing from $6.3bln to $9.45bln and the PSR increasing from 0.4 to 0.6. At last close SBSW was trading at $7.57 per share. For the same annual revenue this implies a PSR increase that is fully off the Ratio Scenario Matrix - an increase of over 100% from 0.4 to 0.5. On the other hand if we assume that the PSR stayed at 0.4 it would require effectively a doubling of revenue from $6.3 bln to $12.6 billion. This would reflect the largest increase in revenue from one year to the next in recent history. The more likely scenario probably lies somewhere in between - with revenue and revenue expectations increasing as a result of higher platinum and gold prices, and investors likely tolerating a higher PSR for the company. ConclusionIn the case of a miner or other commodity-focused company, revenues can be very sensitive to changes in the commodity and varying it along with certain revenue or earnings ratios can give you a ballpark range for valuation. If we take into account only revenue, the recent price of around $7.57 sits in the top right hand corner of the Ratio Scenario Matrix - equivalent to nearly a 50% increase in revenue and a 50% increase in the Price:Sales Ratio.Theme:Stock Valuation Tags:Ratio Analysis, Valuation, Sibanye Stillwater, Commodities, Data from: Yahoo! Finance Disclaimer: Not financial advice. Please review original sources, conduct your own analysis and due diligence, and make your own investment decisions. Author takes no responsibility for the accuracy or inaccuracy of this data. If you want to get in touch you can reach us at hello at hedge-fund dot io |