hedge-fund.io

Welcome to hedge-fund.io - a blog about financial markets.

This is the main page and also hosts the latest post.

Can Apple time the bond market?

Does Apple's recent bond issue contain any signal?

Published: 18 May 2025

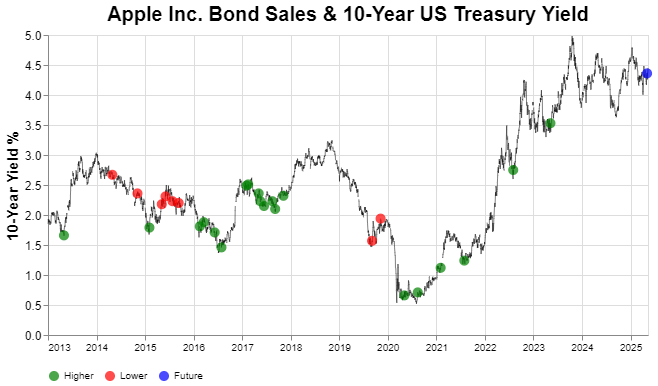

The dots show Apple bond issues since 2013. Green dots (successful guess) are instances where the 10-year yield was higher 1 year after the bond issuance. Red dots (unsuccessful guess): 10-year yield is lower 1-year later than at issue date

|

Key takeaway: 20/28 times the 10-year US Treasury yield was higher 1 year after Apple issued bonds

Compounded over the lifespan of a 40 year bond, or even "just" over the 10 year career of a CFO, those coupons add up to a lot - more than enough to justify the lifetime salary of a good CFO. And when you consider that Apple has traded at a PE ratio of 15-40 over the last 10 years, every additional $1 million of earnings could be worth, in theory, an additional $15-40 million in market capitalisation. So who was behind these decisions? The CFO likely had final say in the amount and timing. Was he any good at market timing? Let’s see. There were 28 instances of declared debt issue* since 2013. For each of these issues we asked whether the yield on the 10-year US Treasury Note was higher or lower 1-year later. In 20 of 28 cases (~71%), the yield was higher, which means it would have cost Apple more in interest had they waited another year to issue the debt. If you assume there’s a 50-50 chance of guessing correctly whether interest rates will be up or down 1-year from today, and that each guess is independent of the other, you can estimate the probability of guessing right 20 or more out of 28 times. Binomial Test - What are the odds of flipping a coin heads (guessing right) 20+ out of 28 times?The binomial probability is given by: $$ P(X \geq 20) = \sum_{k=20}^{28} \binom{28}{k} (0.5)^k (0.5)^{28-k} $$ Put differently: $$ P(X \geq 20) = \sum_{k=20}^{28} \frac{28!}{20!(28-20)!} {0.5}^{(20)} {0.5}^{(28-20)} $$ This simplifies to: $$ P(X \geq 20) \approx 0.0178 $$ We see that the probability is 1.78%. That is a rather small chance.The case of 2013 - Apple’s first debt issue since 1996This analysis is not about cherry picking. But some of the raises deserve special mention. Just look at April 2013. Apple raises $ 17 billion in, at the time, the largest corporate bond issuance in history. The 10-year yield is around 1.7%. A couple of weeks later, Federal Reserve Chair Ben Bernanke highlights the possibility of the Fed trimming bond purchases, arguably leading to the Taper Tantrum.Within a year, the 10-year yield has nearly doubled to 3%. Today there is still a $ 3 billion Apple 2043 bond with a 3.85% yield which might have cost them an additional 1-1.5% if issued just a year later. That’s $30 million a year in lost earnings. And working with a PE ratio (which was presagingly low around 10 that year), that single bond issuance decision was responsible for $300 million of Apple’s market cap that year. Alternatively you could calculate the Net Present Value of such an income stream ($30 million per year) using various discount rates. Different discount rates generate NPVs of anything from $250-$500 million in NPV. Now add the $5.5 billion 10-year bond (redeemed in 2023) issued at the same time and you see the numbers really start to add up. 2013 really was either a masterclass in market timing by Apple, or extremely lucky. In fact, the 10 year yield only went below that 1.7% level twice in more than a decade that followed: in late 2016 and then again during the COVID-19 pandemic. But 2013 was by no means Apple’s only example of timing the bond market. Mid 2016, the 2nd raising in 2020, early 2021, mid 2022 and mid 2023 all occurred mere months or even weeks before yields spiked. So if one of the largest contributions you can make to the bottom line of a company as CFO is through getting the timing of your capital raising right, and one could argue that Apple can afford the best market-timer in the world, then its $4.5 billion raising earlier this month might contain some signal for the broader financial markets. Or Luca Maestri was just really, really lucky. As ever - use it, or don’t use it, at your own risk. Theme: Corporate Credit Tags: Corprate Credit, Bond Yields, Credit Spreads Data from: St Louis FRED, SEC EDGAR* Disclaimer: Not financial advice. Please review original sources, conduct your own analysis and due diligence, and make your own investment decisions. Author takes no responsibility for the accuracy or inaccuracy of this data. If you want to get in touch you can reach us at hello at hedge-fund dot io |